Setting Up an Investment Fund in Europe: Why You Need a Fund Management Company

As you consider setting up an investment fund in Europe, the first steps to take relate to choosing the type of fund you want to establish and the specific European member state. As you go further in the process, at some point you will encounter the concept of fund management company, or ManCo.

ManCo is a term used in the European fund management industry to refer mostly to UCITS management companies and alternative investment fund managers (AIFMs). The term comes sometimes in variations, with Super Manco being the most common one. Whilst it is not a legal term in Europe, Super Manco refers to fund management companies that combine the authorisation to manage both UCITS and Alternative Investment Funds (AIFs). Given the complexity of the regulatory framework for fund management in Europe, in one with the increasing requirements for local substance when setting up a fund, you will definitively need to have a fund management company, likely located in the same European member state where your funds – be it UCITS or AIFs – will be established.

The good news is that you don’t necessarily have to also create your own fund management company when setting up an investment fund in Europe. The leasing model has flourished for quite some time now in the European fund management industry and there are plenty of options for third party management companies to hire and manage your funds.

What is a Fund Management Company

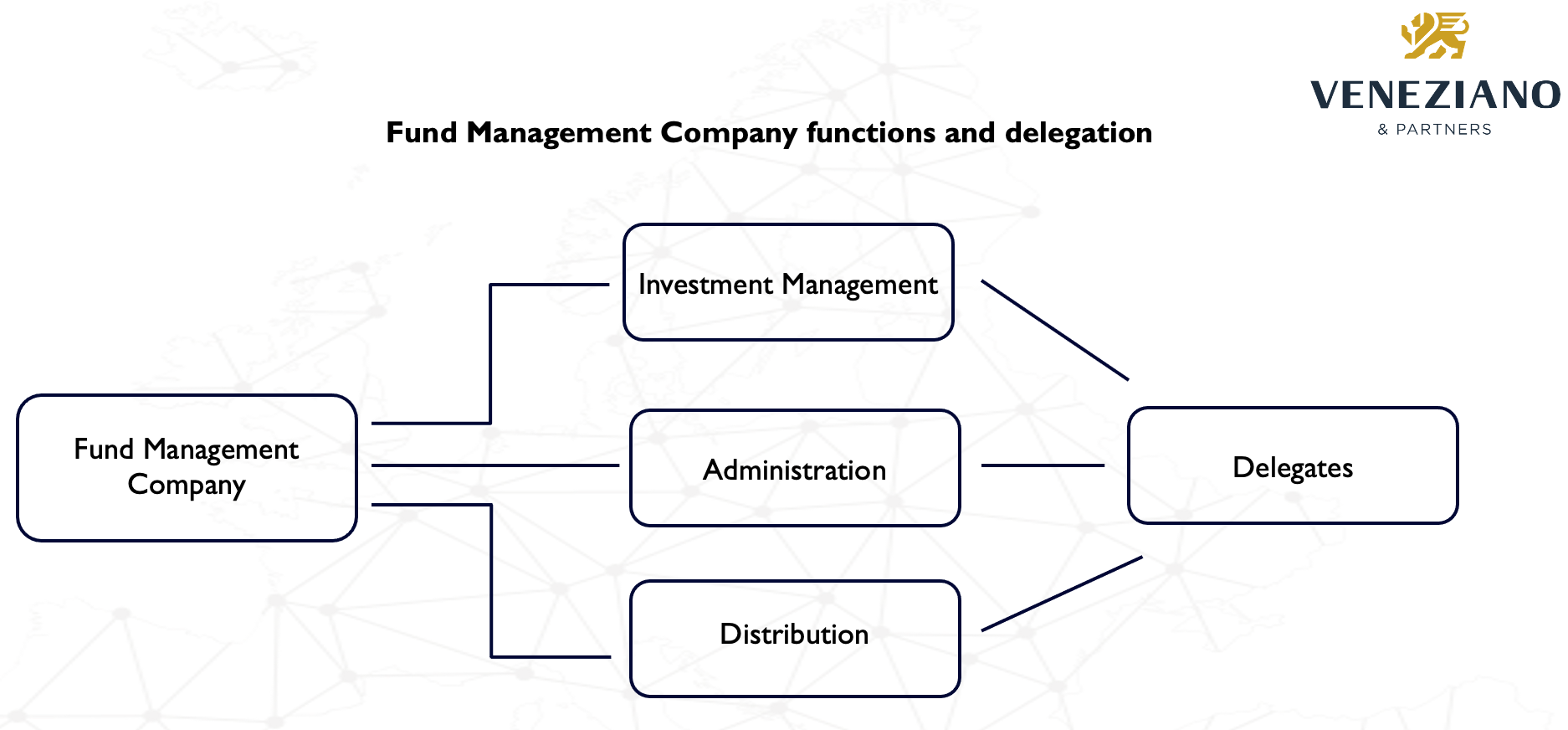

A fund management company is an entity with ultimate responsibility for the management of collective investment schemes. In this context, fund management as a whole is traditionally broken down in three separate functions. These are investment management, administration and distribution. In addition to these functions, fund management companies are also responsible for the risk management function, which typically oversees both investment and operational risk. There are also other ancillary services that fund management companies may carry out. These are by and large related to the management of portfolios of investments, based on ad hoc mandates received by investors, including pension funds.

Whilst in principle a fund management company can carry out all the functions within fund management, most typically all these functions are delegated to third parties. Over the course of the recent past in both the main gateways for Europe, most fund management companies became specialised in the management of third-party funds. Accordingly, at least the portfolio management function is delegated.

One note is appropriate on the concept of delegation. Whilst fund management companies can and indeed do delegate their functions to external third parties, the delegation mechanism does not exonerate them from the ultimate responsibility for the function itself. Accordingly, fund management companies carry out stringent oversight of the third party that receive a specific function in delegation. One of the aspects of this is that the delegates must be licensed to carry out the function they receive in delegation.

Stay in the loop

Subscribe to Veneziano & Partners, our monthly newsletter bringing you the most recent updates and news.Choosing a Fund Management Company

Many areas of concern exist when choosing a fund management company. The existence of a robust governance framework remains undoubtedly the most important one. Governance is of paramount importance and its effects disperse on all the functions carried out by fund management companies. Where governance generally refers to the entire set of controls, policies and procedures that dictate behaviours of corporations, in the specific context of fund management, governance has specific ramifications due to the nature of the fund management business itself.

The reason for governance to be one of the key criteria when choosing a fund management company can be found in the introduction of AIFMD, which is also at the very foundation of the expansion of fund management companies specialised in management of third-party funds. The more stringent conduct of business rules introduced by AIFMD did favour the mushrooming of more independent fund management companies. However, it became very clear quickly what successful fund management companies had to offer. It wasn’t simply substance and/or risk management – as part of a broader group level offer – rather the understanding and on-the-ground expertise in the fund management business, translated in a demonstrable robust governance framework.

Demonstrable Governance

The existence of sound and demonstrable governance in the activities of a fund management company is typically tested relative to staffing, delegates oversight and the so-called organisational effectiveness. For being substance providers, fund management companies are required to ensure appropriate level of resources to effectively implement their operational frameworks. The minimum number of full-time resources varies depending on the specific domicile of establishment. Same goes for the local designated persons in charge of monitoring and overseeing the main functions as delegated to external third parties.

Demonstrable governance in this context translates in the quality of the board reporting provided by the so-called designated persons in charge of monitoring the delegation to third parties. The reporting should be comprehensive, demonstrate constructive challenge as well as interrogation of the information received by the overall staff of a fund management companies. For what concerns delegated functions and delegates overall, it is important to provide supporting evidence that appropriate due diligence has been carried out on delegates both on an initial and ongoing basis.

Demonstrable governance here means that when selecting delegates, to the maximum extent possible, due diligence policies and procedure implemented by the fund management company itself are used, rather than simply relying on the ones of the specific delegate. However, when relying on delegate due diligence policies, there should be evidence that the policies and procedures are evaluated and approved as being fit for the fund management company.

Last but not least, demonstrable governance is especially important for what concerns the dynamics involving the board of directors of a fund management company. When choosing a fund management company, it is of paramount importance to ask and receive clear and demonstrated evidence about the involvement of the board in the overall operations, including requesting samples of standard board reporting.

Conclusions

The business of fund management companies witnessed increasing consolidation over the course of the past years in both the European gateways for investment fund establishment. Accordingly, the market for these services tends to be concentrated in few hands nowadays. Concentration has made the service more efficient also because of the increasing economies of scale. It also made it less flexible and personalized. There remain few examples of smaller fund management companies that can combine an efficient service with a boutique approach to clients.